As a bookkeeper based on the Gold Coast, I’ve worked with a wide range of small businesses—from law firms and cafes to tradies, freelancers, and creative agencies. Over the years, I’ve had hands-on experience with multiple accounting platforms, including MYOB and Xero.

Both systems are well-established in the Australian market and have strong features. But after years of comparison, I made the switch to Xero—and here’s why it’s become my go-to platform for clients across different industries.

Understanding MYOB and Xero: A Brief Overview

Before diving into my reasons, let’s take a quick look at what both platforms offer.

MYOB (“Mind Your Own Business”) has long been a trusted name in Australian accounting software. It offers powerful desktop and cloud-based solutions with deep features, particularly around inventory and payroll.

Xero is a newer cloud-based system that has grown rapidly, especially among small business owners. With its clean interface, real-time reporting, and seamless integrations, Xero has made accounting more accessible and collaborative.

Why I Switched to Xero: Key Reasons

1. Client-Friendly Interface

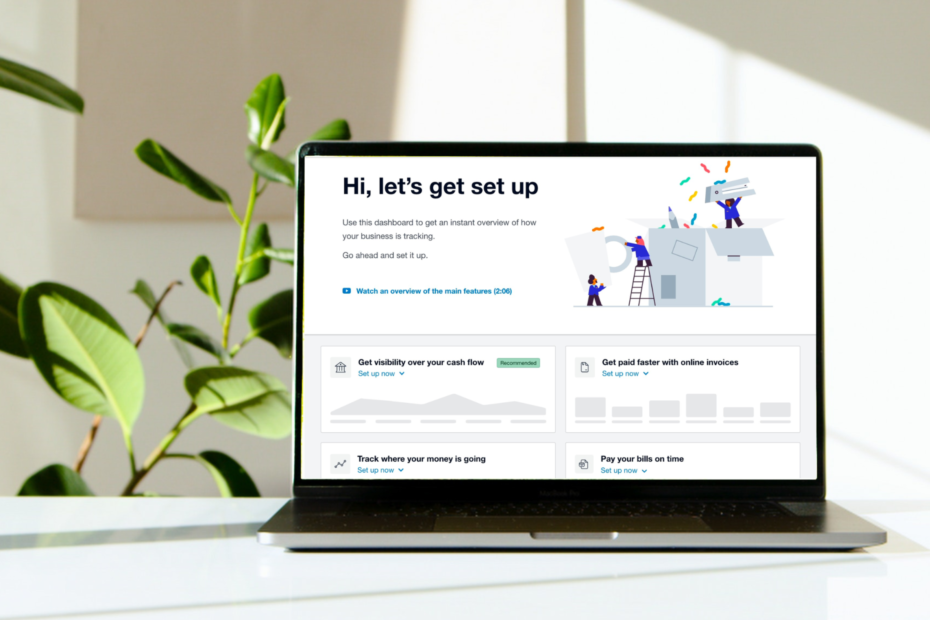

Xero’s dashboard is clear, visual, and easy to understand—even for those who aren’t numbers people. Business owners love being able to log in and instantly see where things stand: money in, money out, upcoming bills, and bank balances.

While MYOB offers powerful tools, its interface can feel a bit more technical and overwhelming for clients who just want to check on their finances quickly.

2. Real-Time Bank Feeds and Reconciliation

Xero’s bank feeds are not just accurate—they’re fast. It pulls in transactions daily, and with bank rules and smart matching, reconciling takes minutes. For busy restaurant owners or construction managers, this is a game changer.

MYOB also offers bank feeds, but I’ve found them to be slightly slower and sometimes less intuitive to work with.

3. Mobile Access and Cloud Collaboration

With Xero, my clients can access their financial data anywhere—at the café, on site, or between meetings. This level of flexibility suits modern business owners who don’t want to be tied to a desktop.

MYOB has made strong improvements in its cloud offerings, but Xero’s native cloud-first design gives it the edge in mobility and remote collaboration.

4. Integration with Business Tools

Whether it’s rostering software for a hospitality business, time-tracking apps for freelancers, or project management tools for agencies—Xero integrates easily.

MYOB has a range of integrations too, but Xero’s ecosystem is broader and easier to connect with third-party apps.

5. Clear Pricing and Add-ons

Xero has transparent, tiered pricing that scales with the needs of a growing business. Add-ons like payroll and multi-currency are optional, so clients only pay for what they use.

MYOB offers comprehensive packages but some businesses found themselves paying for features they didn’t need.

The Pros and Cons: MYOB vs Xero

| Feature | MYOB | Xero |

| User Interface | Feature-rich, but more complex | Clean, simple, user-friendly |

| Bank Feeds & Reconciliation | Reliable, but slightly slower | Fast, intuitive, rule-based |

| Mobile Access | Available, still evolving | Seamless, cloud-native |

| Integration Ecosystem | Growing, but limited | Extensive and well-supported |

| Pricing Structure | Broad packages | Modular, scalable pricing |

| Local Support | Strong Australian base | Strong local and global support |

Why Xero Works for My Clients

Law Firm Owners

Lawyers appreciate the clean reporting, trust accounting features, and secure sharing of financials with their bookkeeper. It helps them stay compliant and focused on clients, not admin.

Restaurant and Café Owners

In hospitality, time is everything. Xero’s POS integrations and bank rules simplify end-of-day bookkeeping, payroll, and BAS. Plus, it keeps cash flow visible at a glance.

Construction and Tradies

Job tracking, quoting, and invoicing are simple with Xero. Combined with apps like ServiceM8 or Fergus, it fits seamlessly into the tools tradies already use.

Freelancers and Online Businesses

Freelancers love Xero for its simplicity. Tracking income, GST, and expenses is easy, and the mobile app means they can invoice on the go.

Marketing and Creative Agencies

Agencies use Xero to manage projects, track time, and monitor retainer work. Paired with apps like WorkflowMax, it gives clarity across finance and operations.

Final Thoughts: Why I Recommend Xero for Gold Coast Small Businesses

Switching to Xero wasn’t just about me—it was about what worked best for my clients. Most of them want clarity, ease of use, and flexibility—without having to be finance experts.

Xero strikes the right balance between simplicity and functionality. It makes collaboration easier, reduces time spent on admin, and gives small business owners the confidence to stay on top of their numbers.

If you’re a Gold Coast business owner thinking about switching accounting platforms or want to get more from your bookkeeping, I’d be happy to help you explore if Xero is the right fit.

Want to see how Xero could work for your business? Book a free chat here.